EFRIS: Uganda manufacturers disagree with traders

KAMPALA. The Uganda Manufacturers Association (UMA) has expressed its backing for the Electronic Fiscal Receipting and Invoicing System (EFRIS) while also pinpointing shortcomings in its execution by government agencies.

UMA Chairman Deo Kayemba noted that although the system is crucial for effective tax administration, taxpayers lack understanding of it, as well as the tax structure, emphasizing the need for thorough public awareness before implementation.

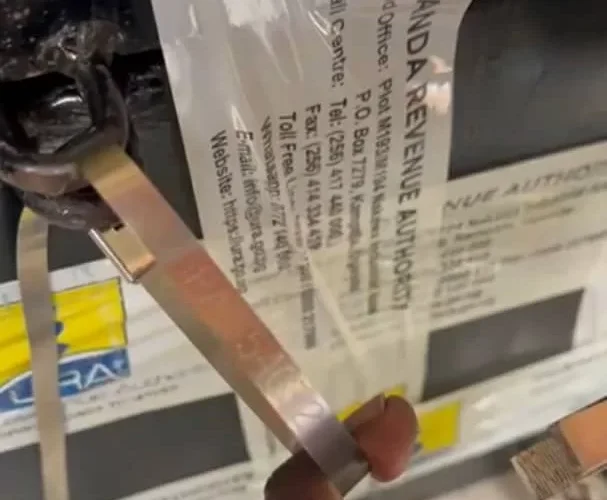

EFRIS facilitates real-time issuance and management of e-receipts and e-invoices for business operations, streamlining daily transactions and administration.

Transactions initiated through the system promptly transmit details to tax authorities for e-receipt and e-invoice generation, primarily aimed at monitoring value-added tax (VAT) payment and ensuring proper record-keeping.

However, traders in Kampala and nearby regions have contested the system, alleging double taxation, as goods they trade have already incurred taxes at earlier stages. Uganda Revenue Authority (URA) refutes this claim, asserting VAT imposition at all supply chain levels per legal provisions.

URA maintains consistent engagement with trade associations and taxpayers, clarifying EFRIS’s significance and functionality, countering assertions of abrupt implementation.

Kayemba insists URA should assume responsibility for installing equipment necessary for electronic invoicing, suggesting compensation for compliant traders and advocating phased implementation to ensure smooth adoption.

UMA proposes a $50,000 capitalization threshold for VAT applicability, mirroring the investment license requirement, urging authorities to engage aggrieved traders for resolution, including addressing unfair competition from manufacturers with retail outlets.

Despite the Competition Act 2023 enactment, pending implementation obstructs addressing traders’ concerns effectively. Kayemba calls for expeditious operationalization through committee establishment and regulatory issuance.

Regarding garment taxation, UMA opposes altering specific duty rates for textile trade, contrasting protesting traders’ call for fabric and garment tax suspension. Kayemba argues such duties are vital for local industry protection, citing increased investment resulting from 2021 tax amendments

I was recommended this website by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are wonderful! Thanks!

https://www.smortergiremal.com/